Ground Lease

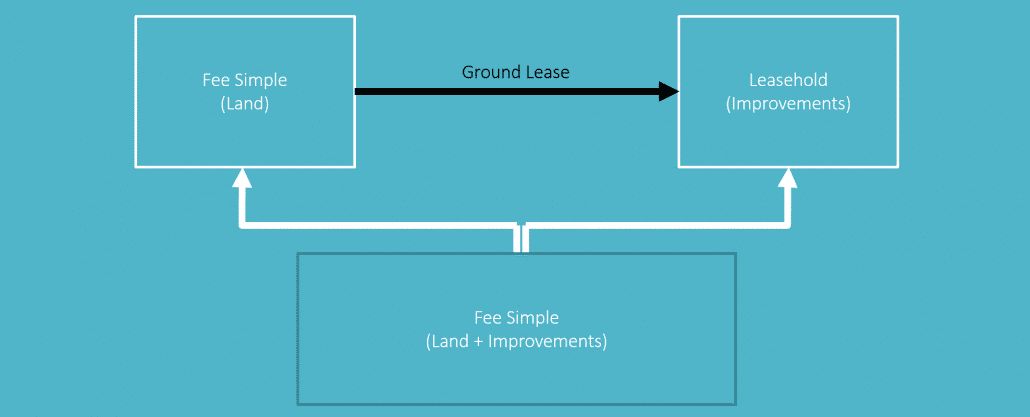

A lease structure where a real estate investor rents the land (i.e. ground) only. In the case of a ground lease, generally one party owns the land (i.e. fee simple interest) while a separate party owns the improvements (i.e. leasehold interest). In most cases, the owner of the land leases the land to the owner of the improvements for an extended period of time (20 – 100 years).

When the ground lease predates a mortgage on the leasehold interest, the ground lease generally has priority over that mortgage unless the ground lease is expressly subordinated to the mortgage. Thus, a ground lease is often thought of and valued as a form of financing.

The ground lease is a common vehicle used by generational families to generate cash flow from well-located parcels of land without having to operate the property nor give up ownership in the property. For instance, the Martinez family owns a 10-acre parcel at the corner of main and main. They lease the parcel for $100,000 per year to Jennifer’s Bakery for 50 years, who in turn builds a bakery on the property. Jennifer’s Bakery operates a bakery on the property for the next 50 years and at the end of the ground lease term, returns the land together with any improvements on the land to the Martinez Family.

Putting ‘Ground Lease’ in Context

In 2010, Midtown Grace Church, a historic congregation in Midtown Manhattan, faced a pressing financial need to fund the preservation of its 150-year-old building. The church owned a prime one-acre parcel of land just a block from Times Square, valued at over $50 million. Rather than sell the land and lose control of its generational asset, the church entered into a ground lease agreement with Zenith Hospitality Group, a luxury hotel operator.

The Agreement

Under the terms of the ground lease, Midtown Grace Church leased the land to Zenith Hospitality Group for an initial term of 99 years. Zenith agreed to pay $3 million annually in base rent with periodic escalations every 10 years tied to the Consumer Price Index (CPI). The church retained fee simple ownership of the land, while Zenith was granted leasehold ownership of the improvements, which included the luxury Zenith Midtown Hotel, a 40-story, 500-room property built on the site.

Key Considerations

- Financing and Subordination: Zenith financed the construction of the hotel with a $150 million mortgage secured by its leasehold interest in the property. However, the ground lease was not subordinated to the mortgage, meaning that if Zenith defaulted on the mortgage, Midtown Grace Church’s rights as the landowner would remain intact. This made the church’s ground lease position highly secure.

- Revenue Stability for the Church: The church benefits from a predictable, long-term revenue stream of $3 million annually with no responsibility for the operation or maintenance of the property. This income supports the church’s preservation and community programs.

- Future Reversion of Improvements: At the end of the 99-year lease term, ownership of the land, along with the improvements (i.e., the hotel), will revert to Midtown Grace Church. By that time, the hotel is likely to be fully depreciated and may require redevelopment, offering new opportunities for the church or its successors.

Financial Implications

For Midtown Grace Church:

- The $3 million annual rent provides a 6% yield based on the land’s estimated $50 million value.

- Over the lease term, the church will earn a projected $297 million in nominal rent, assuming no CPI adjustments.

For Zenith Hospitality Group:

- By leasing the land, Zenith avoided the significant upfront cost of purchasing prime Midtown Manhattan real estate, allocating capital to developing and operating the hotel instead.

Lessons from the Case

This example illustrates how a ground lease can be a powerful tool for a landowner to monetize high-value real estate while retaining long-term ownership. For Midtown Grace Church, it allowed them to generate significant income without relinquishing their generational asset, while Zenith Hospitality Group gained access to a prime location for their luxury hotel without the burden of acquiring the land outright.

Click here to get this CRE Glossary in an eBook (PDF) format.