Exploring Latin America’s Real Estate Markets: Mexico

In this second article of our Exploring Latin America’s Real Estate Markets series, we turn our attention to one of the most robust and strategic markets in the region: Mexico. Unlike other Latin American economies, the Mexican real estate sector has benefited from its geographic proximity to the United States, its network of trade treaties and the rise of nearshoring, factors that have reshaped the investment landscape in recent years.

Mexico not only stands out for its economic dynamism, but also for the breadth and maturity of its submarkets: from “hubs” or industrial centers in the north of the country, to residential and tourist corridors in the southeast. These factors have provided a fertile environment for both institutional investment and the development of innovative projects in housing, logistics, hospitality and offices.

This installment offers a concrete vision of the most relevant transformations that are occurring in the Mexican real estate market. We’ll look at recent investment data, review how industry players are adapting to new market demands and explore trends that could set the tone in 2025 and beyond.

The first post in our blog series on real estate markets in Latin America starts with a deep dive into Colombia—its current landscape, emerging trends, and the opportunities shaping the sector. Read it here: Exploring the real estate market in Colombia

The Mexican Real Estate Market: Figures and Projections

Mexico is preparing to attract real estate investments for an estimated 652,000 million pesos in 2025, which is equivalent to more than 32 billion dollars. Sustained growth of 15% per year is anticipated, driven by the consolidation of new development poles, particularly in sectors such as industrial, vertical residential and tourism.

Trends Shaping the Market

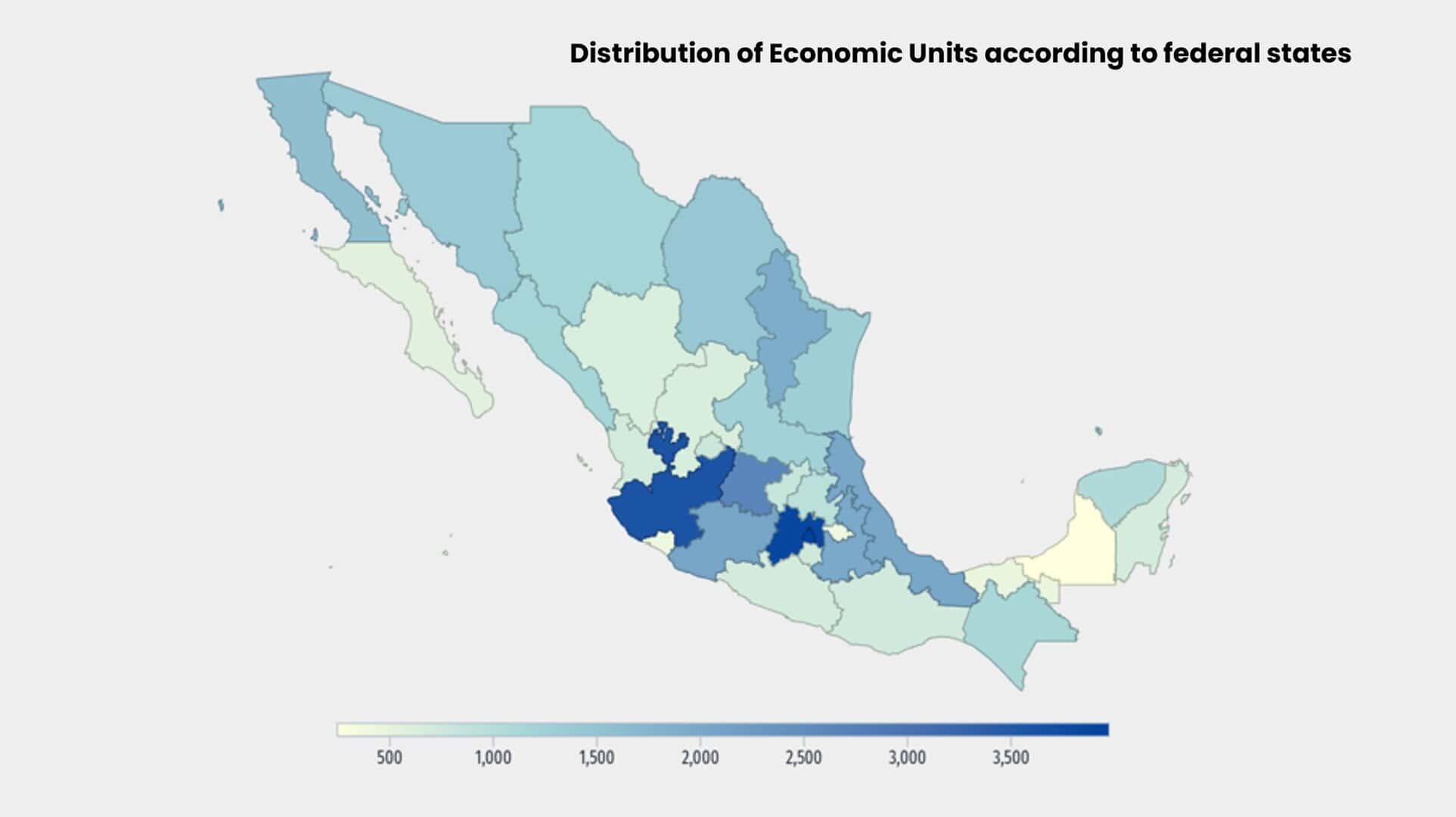

- Nearshoring as an industrial engine: The relocation of foreign companies is generating an unprecedented demand for industrial warehouses and logistics parks, especially in states such as Nuevo León, Chihuahua and Baja California.

- Demand for sustainability: Investors and developers are incorporating ESG criteria and green technologies in new projects, with a clear focus on energy efficiency and environmental certification.

- Digitization of real estate processes: Tools such as virtual reality, integrated CRMs, and predictive analytics are transforming marketing and asset management processes.

- Growth in intermediate cities: Places such as Querétaro, Mérida and León are positioning themselves as preferred destinations for investment due to their connectivity, population growth and environments conducive to orderly urban development.

Mexico: Economic Outlook and Implications for the Real Estate Sector

The Mexican economy is going through a moment of relative macroeconomic stability, with GDP growth projected at around 2.4% by 2025, inflation that has moderated to levels close to 4.4%, and an exchange rate that has shown strength against the dollar, thanks to growing flows of foreign investment. This environment has generated favorable conditions for real estate development, although it also imposes specific challenges by segment and region.

Unlike other markets in the region, the Mexican peso has remained competitive, which reduces short-term incentives for speculative foreign capital, but strengthens the confidence of institutional investors in medium- and long-term projects. In the labor field, the unemployment rate remains at historic lows, close to 2.9%, which supports a growing demand for urban housing, industrial infrastructure and commercial spaces in areas with high economic density.

However, structural challenges remain. Access to housing remains limited for large sectors of the population: more than 45% of workers are in informal labor conditions, which makes it difficult for them to access traditional mortgage credit. This has driven the growth of rent-to-own schemes, social housing developments, and new housing solutions aimed at the emerging middle class.

For investors and developers, the current environment suggests a double strategy: on the one hand, to take advantage of the boom in sectors such as manufacturing, and on the other, to design resilient and flexible real estate products in the face of the fragmentation of purchasing power. The economic cycle is favorable, but strategic execution will be key to capturing sustained value over time.

Public policies, exchange rate stability and climate for foreign investment in Mexico

Mexico’s macroeconomic environment has been relatively stable compared to other emerging economies, thanks to prudent fiscal management, credible monetary policy, and sustained openness to foreign investment. However, that same stability faces new pressures ahead of the 2024-2025 election cycle, with direct implications for the housing market.

Fiscal policy: Despite the growth of public spending on infrastructure, social programs, and energy subsidies, the federal government has maintained a manageable fiscal deficit, estimated at 4.9% of GDP for 2024, the highest of the six-year term. While this fiscal expansion seeks to shore up investment and consumption, it has also raised concerns about the need for future tax reform. The fiscal decisions of the next administration will be key to anticipating investor appetite and the sustainability of spending on housing and urban infrastructure.

Exchange rate and monetary policy: The Mexican peso has shown one of the best resilience among emerging currencies, trading below 20 pesos per dollar for much of 2024. This soundness is partly due to the contractionary monetary policy of the Bank of Mexico, which has kept the reference rate at high levels (currently at 11.00%) to control inflation. While this policy has managed to stabilize prices, it has also made financing more expensive, directly affecting the viability of new real estate developments, especially those that rely on intensive leverage.

Foreign investment climate: Mexico maintains a policy open to international investment, particularly in the industrial, logistics and tourism sectors. Nearshoring has catalyzed a new cycle of direct investment, especially in the north of the country, where states such as Nuevo León and Coahuila have recorded record levels of absorption of industrial space. However, areas of regulatory uncertainty persist around land use, foreign ownership in restricted areas (such as coastlines), and permitting processes at the municipal and state levels.

Mexico: Keys to the Real Estate Sector and Statistics

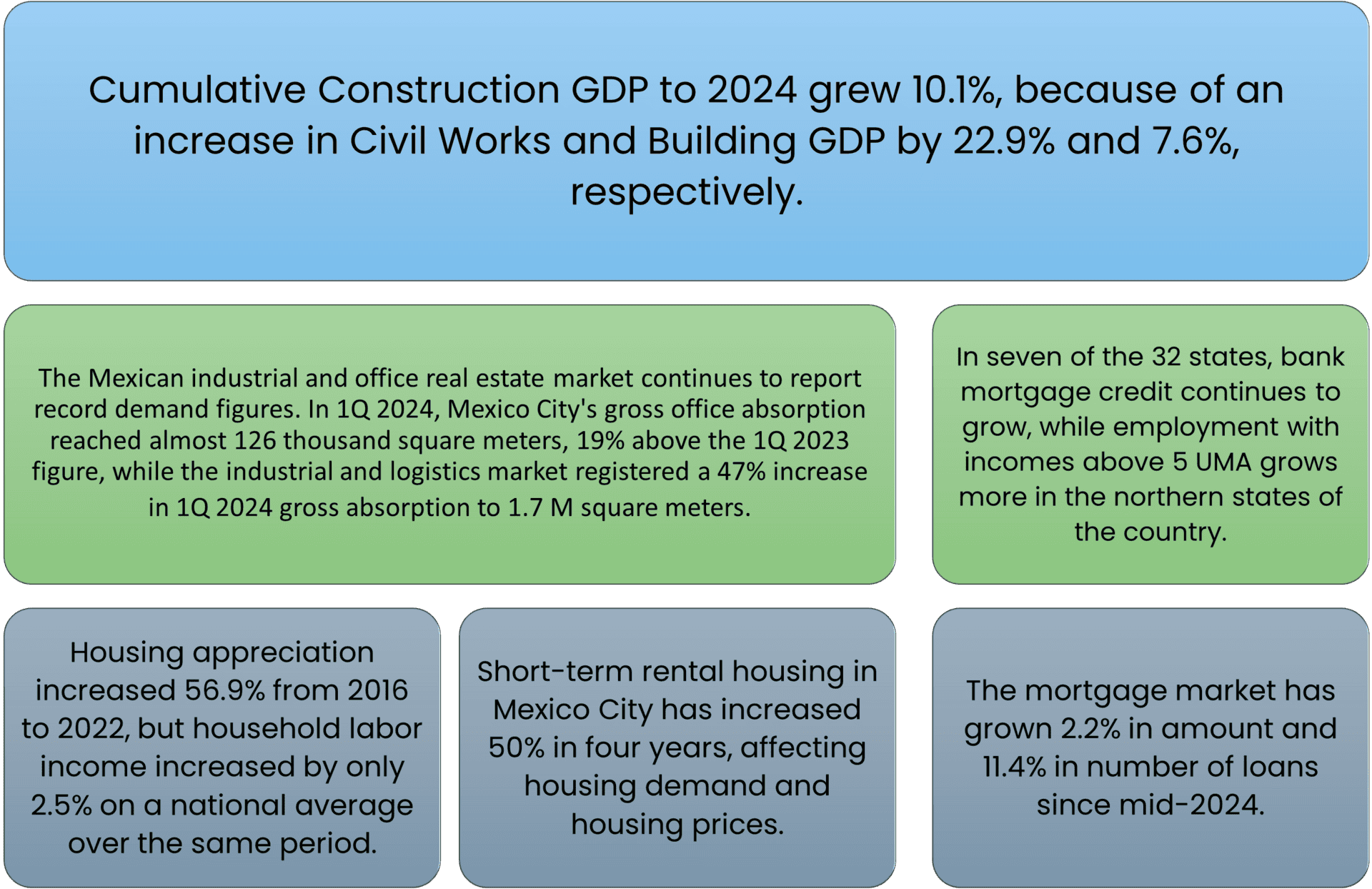

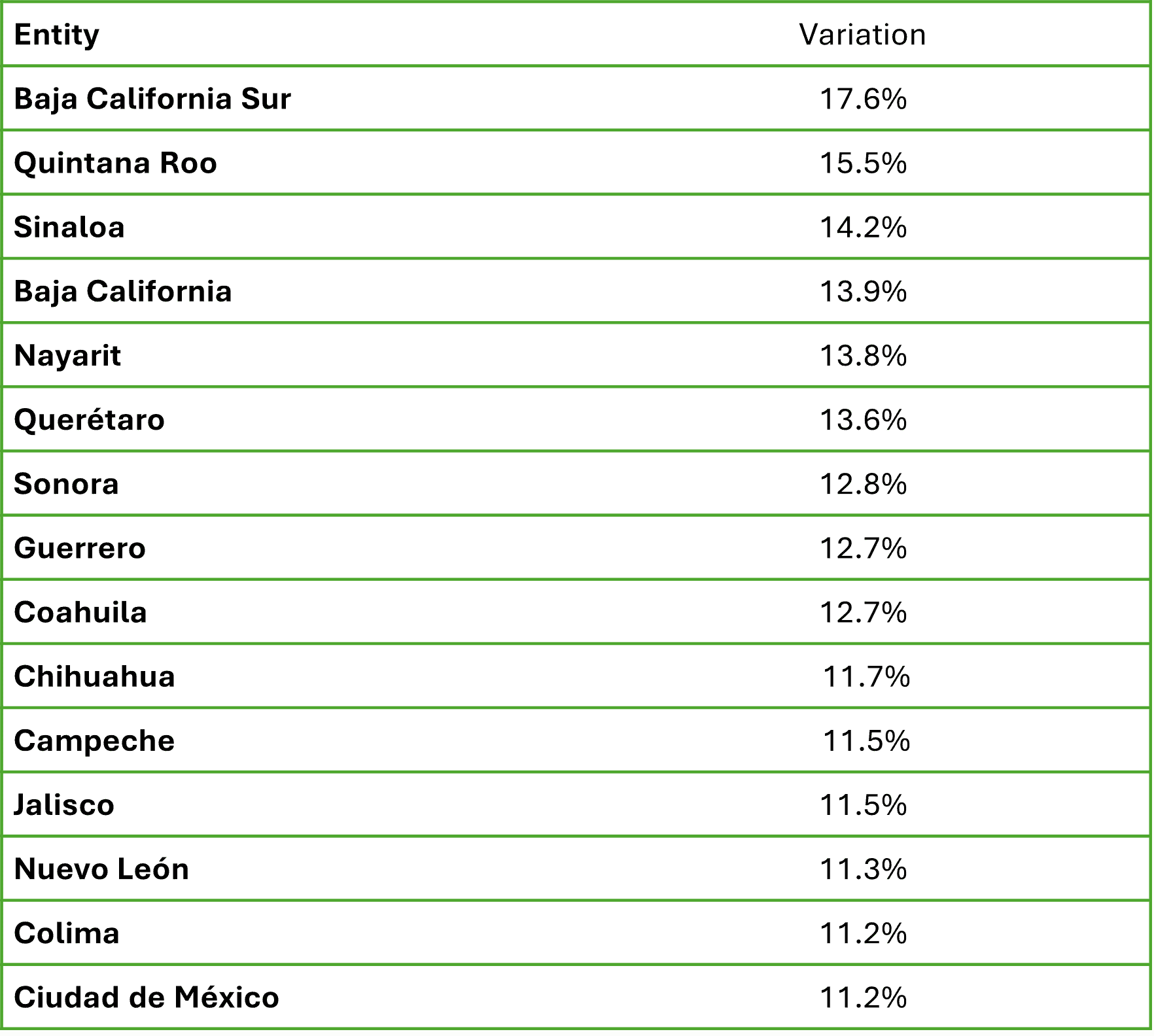

New Home Price Index in Mexico

In the case of Mexico, the measurement of the behavior of new housing prices oversees the Federal Mortgage Society (SHF), which publishes the SHF Home Price Index on a quarterly basis, a key reference for evaluating trends in the residential sector at the national and state levels.

During the third quarter of 2024, the SHF Index reported an average annual increase of 8.5% in the prices of housing with mortgage credit, in line with the trends observed in recent years. This figure reflects a slight slowdown compared to the 9.4% growth recorded in the same quarter of 2023 but still shows an active appreciation dynamic in the Mexican residential market.

Segmentation by type of property:

- New housing showed a 9.2% increase in its annual value, driven by the shortage of supply in consolidated urban areas and the increase in land prices.

- Used housing grew by 7.8%, reflecting lower demand pressure, but still above general inflation.

Recent annual evolution of the SHF index (average national changes):

- 2020: +5.5%

- 2021: +7.7%

- 2022: +9.1%

- 2023: +9.4%

- 2024: +8.3%

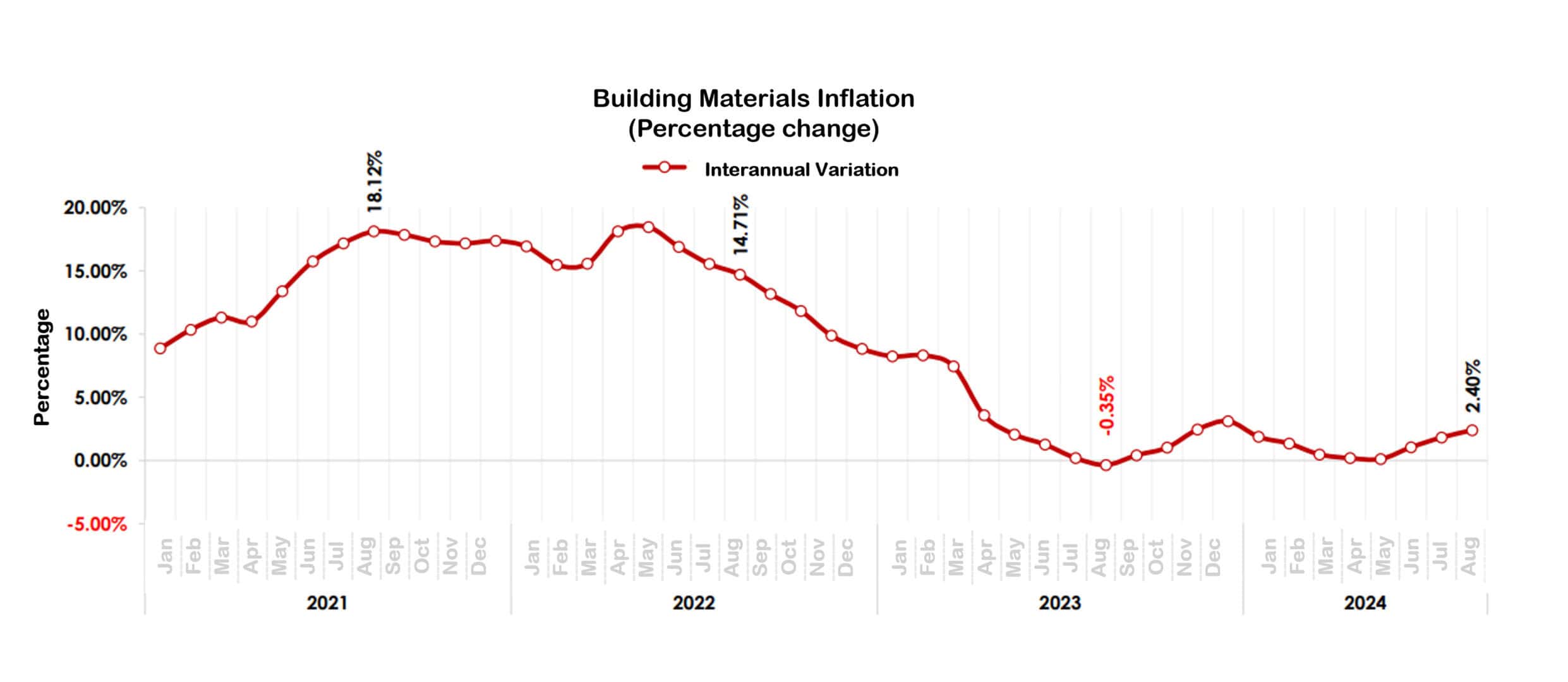

The sustained appreciation in prices responds to several structural factors: resilient demand driven by the formation of new households, low production of affordable housing, higher prices of construction materials and pressure on urbanization costs. Added to this is a geographical reconfiguration of demand, which has led to the growth of areas such as Querétaro, Puebla, Mérida and León.

At the same time, the trend in prices shows a polarization of the market: while the premium areas in Mexico City, Monterrey or Guadalajara continue to rise due to inventory shortages, affordable housing faces lags in supply and high production costs that make effective access difficult for middle and low segments.

Data Table: Housing Price Index Change by Region (2024)

Home Mortgage Portfolio (CVH)

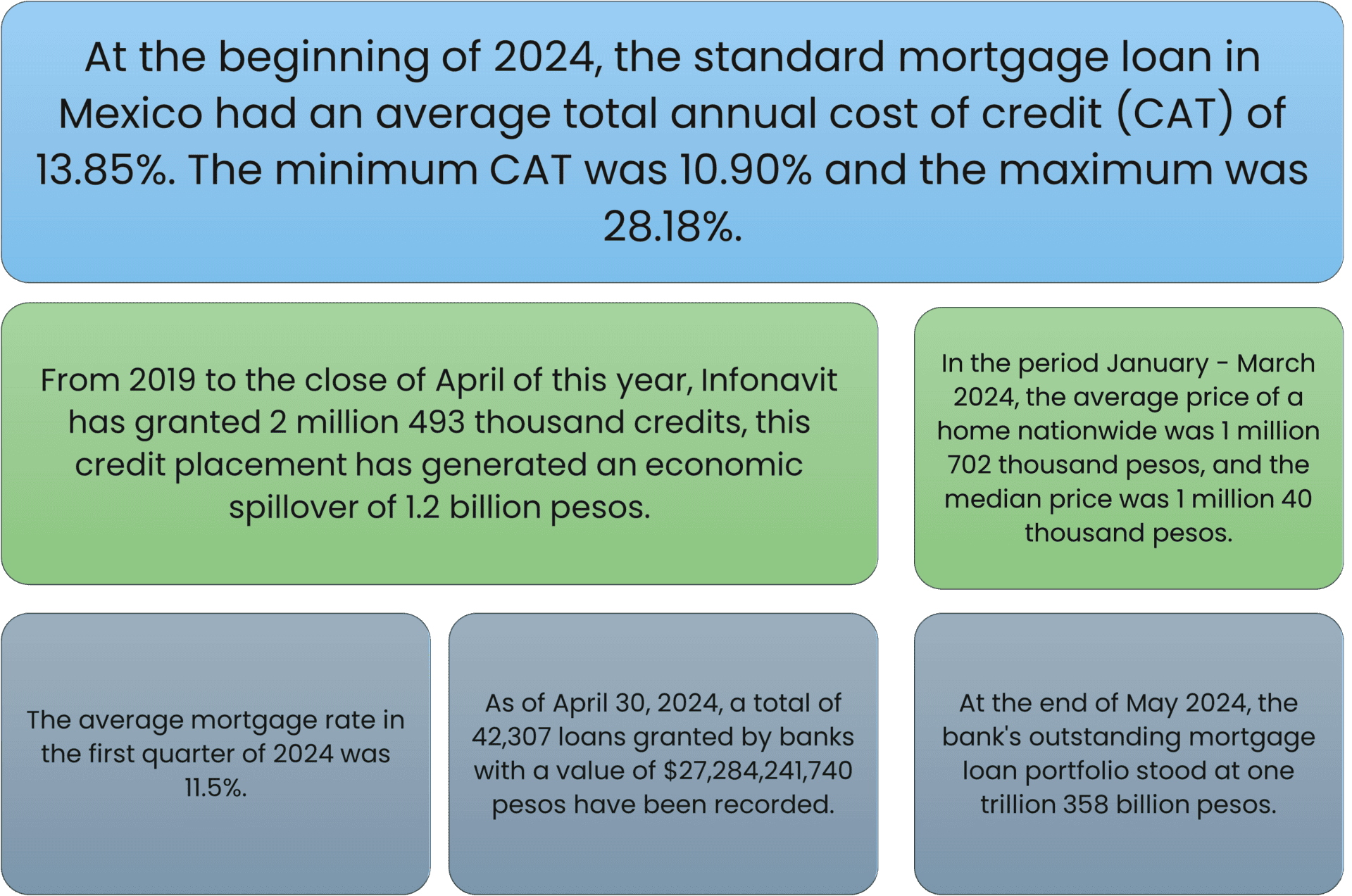

The mortgage portfolio in Mexico has shown signs of recovery and moderate growth in 2024. At the end of May, the banks’ current mortgage loan portfolio stood at 1.358 trillion pesos (64.98 billion USD), evidenced by a nominal increase of 8.2% compared to the same period of the previous year. This growth suggests stabilization in the credit market, although financial institutions maintain prudent lending criteria to preserve portfolio quality.

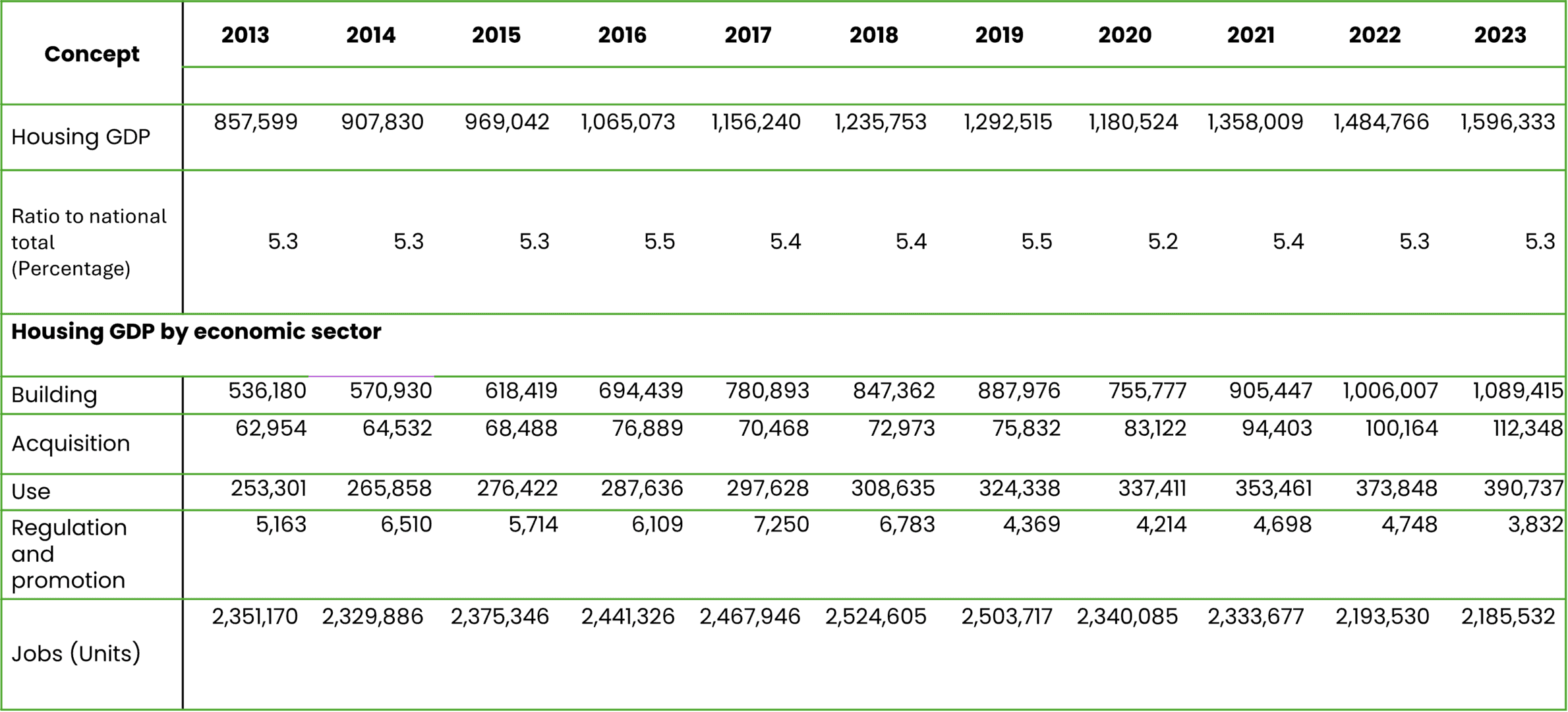

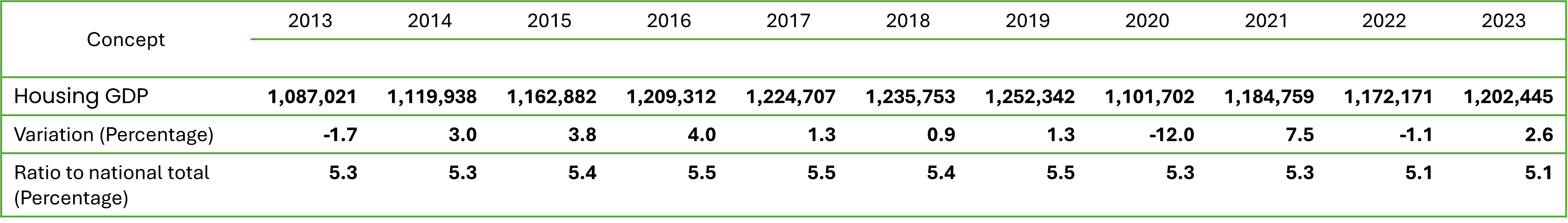

Construction Industry Statistics

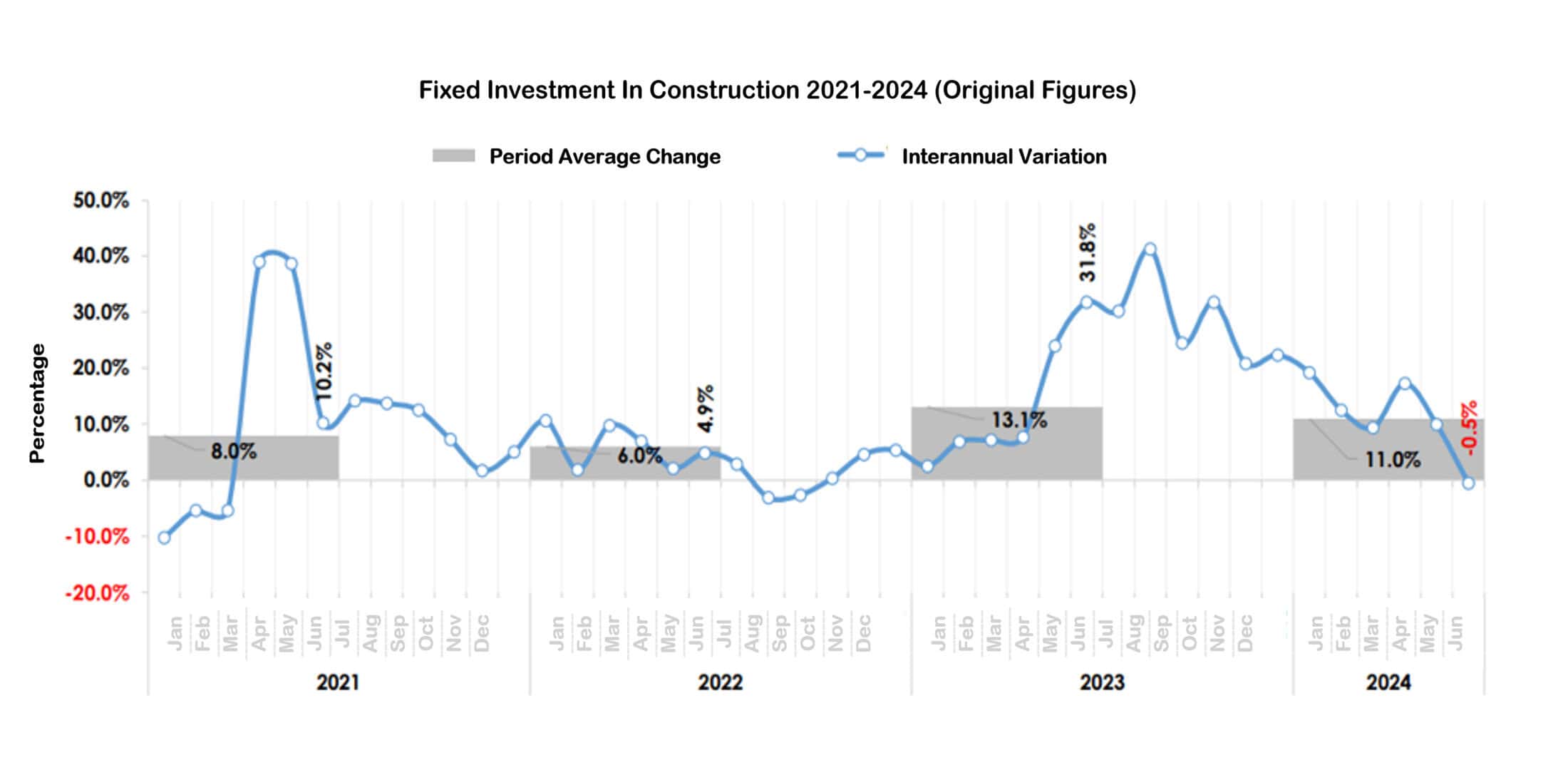

The construction industry in Mexico has undergone notable fluctuations throughout 2023 and 2024. In the first quarter of 2023, construction investment by companies rebounded with a real growth of 21.0% compared to the same period in 2022. However, toward the end of 2023, the sector faced a decline, averaging a monthly contraction of around 10%, culminating in a 0.5% annual drop.

In contrast, the January–June 2024 period showed signs of recovery, with investment increasing by approximately 11% in real terms. Despite this rebound, July 2024 registered a 0.9% month-over-month decline in production value, reflecting ongoing volatility in construction activity.

Construction License Statistics

Building licenses serve as a leading indicator of future activity in the sector. Although recent specific data is not available from the sources consulted, fluctuations in the number of licenses granted reflect a cautious approach on the part of developers, possibly due to economic uncertainties and changes in market demand.

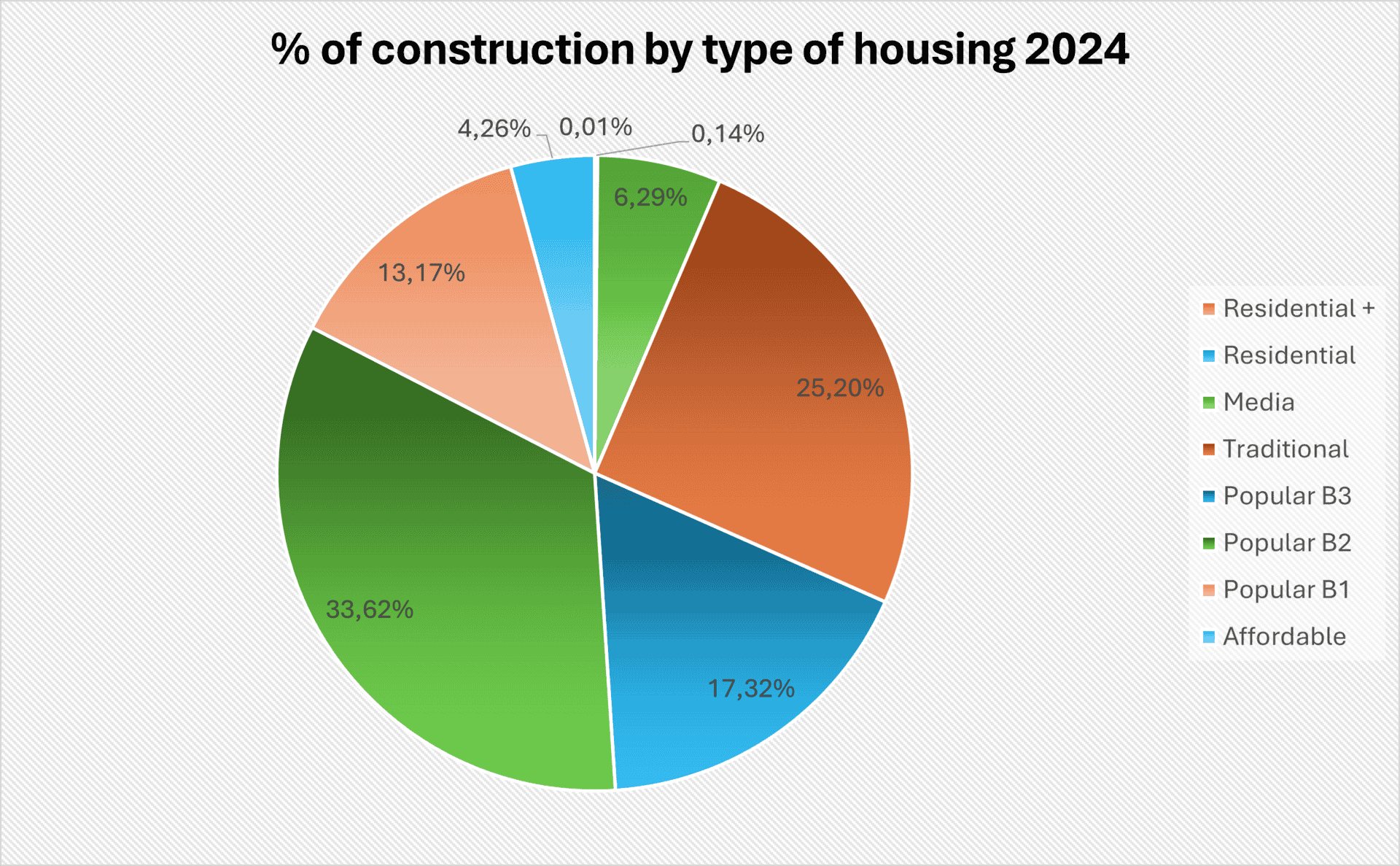

Graph: % Construction by type of housing

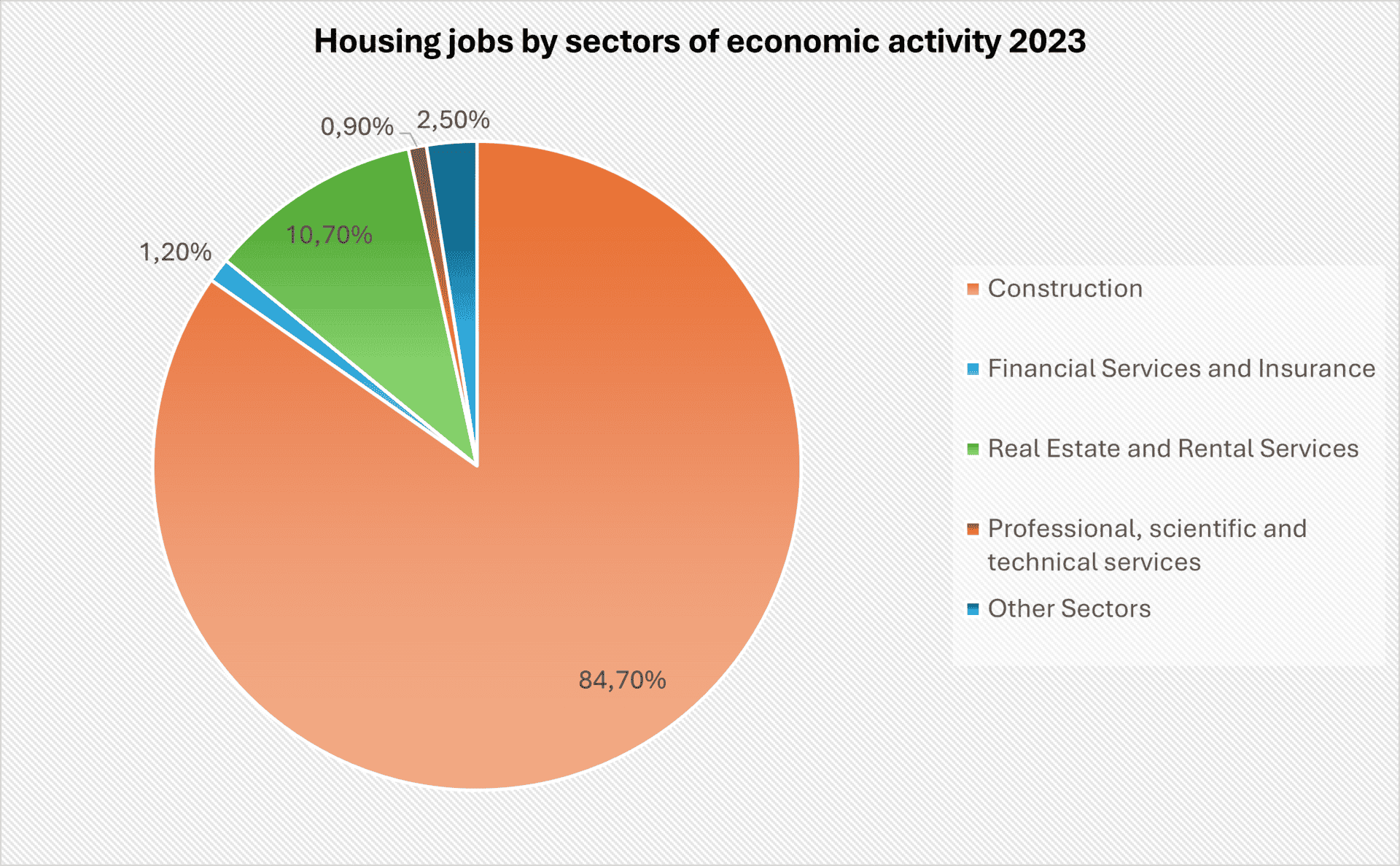

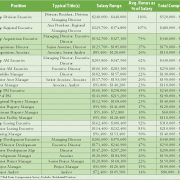

Graph: Jobs and their participation in the construction sectors

In Mexico, the B1, B2, and B3 classifications within the real estate sector are used to segment popular housing, a category defined primarily by its price, physical characteristics, and socioeconomic profile of the buyer. These labels come from classification methodologies such as those used by the Federal Mortgage Society (SHF), CANADEVI (National Chamber of the Housing Development and Promotion Industry), or developers in market studies. B1 is classified as the cheapest and B3 Consolidated popular housing, located in more urbanized areas, with better access, transport and services.

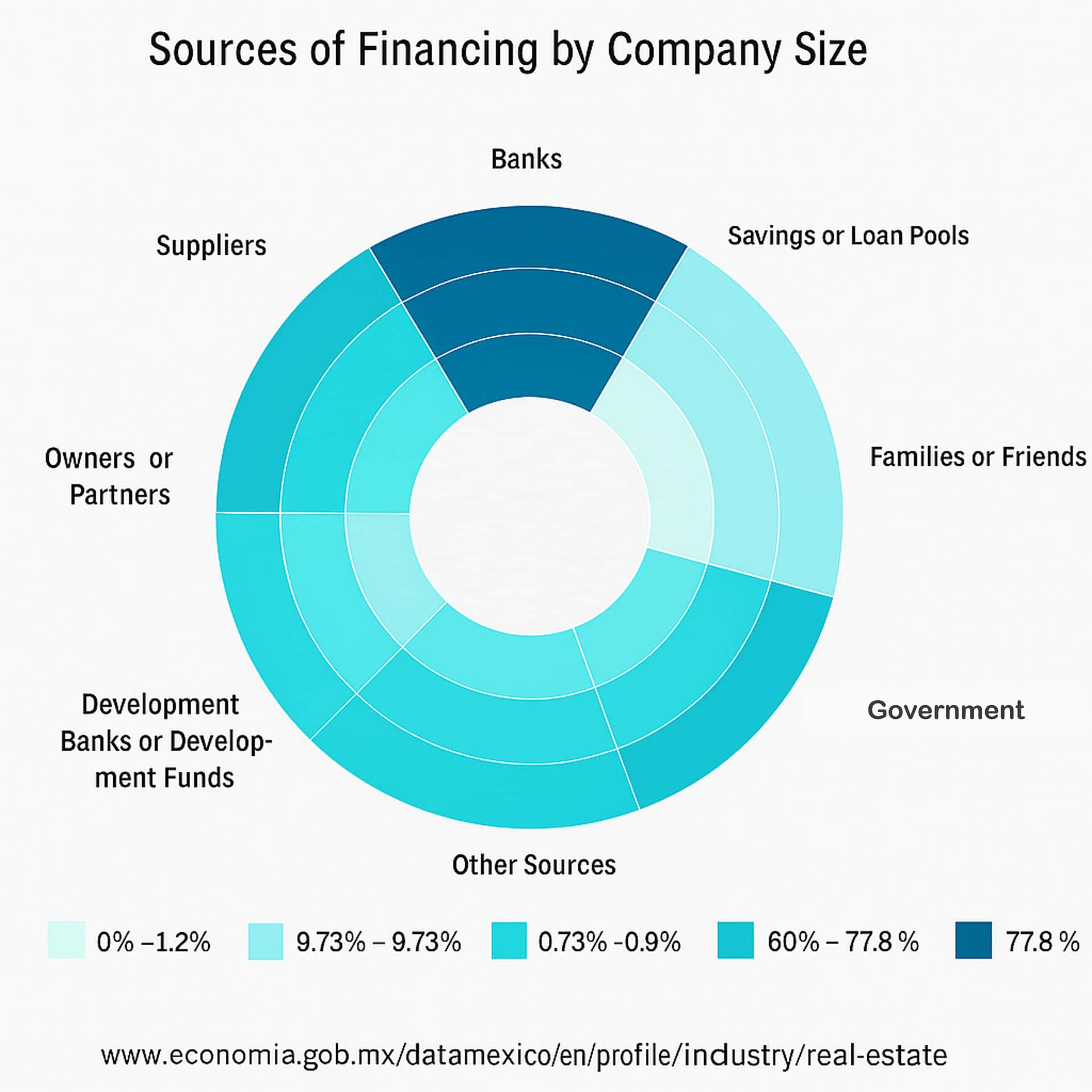

Housing Finance

Trends in housing finance reveal changes in mortgage lending and accessibility. During the first seven months of 2024, banks financed 68,000 mortgage loans, reflecting a nominal growth of 8.2% in the mortgage portfolio. However, the total number of mortgage loans granted in 2024 is projected to reach 735,160, indicating a possible decrease compared to previous years. Factors such as economic conditions and government policies influence these trends.

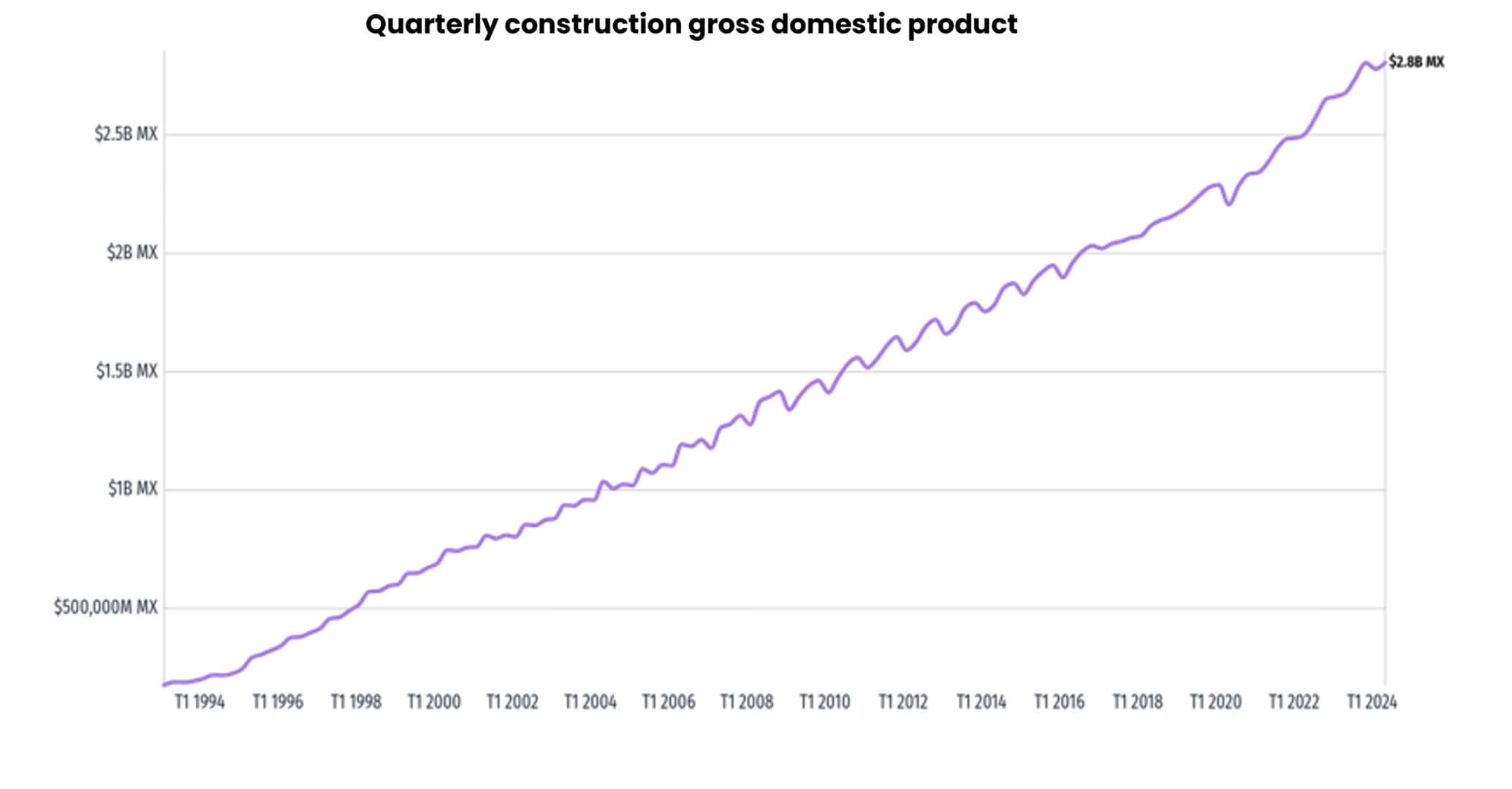

Construction Valuation Index (Construction GDP)

It was expected that during 2022, the recovery process of the sector would compensate for the result of 2020, however, variables such as general inflation and inflation in construction inputs, the rise in interest rates, the conflict between Russia and Ukraine and trade tensions diminished the recovery.

During 2023, the sector observed a recovery, standing at 15.6% compared to the same period in 2022, when comparing December against December 2022 it registered a recovery of 14.8%, likewise, in its monthly comparison with 0.1%

Graph: Evolution of the GDP of construction

Foreign Investment and Market Accessibility in Mexico

Mexico has established itself as one of the most attractive destinations for foreign direct investment (FDI) in Latin America, thanks to a combination of strategic factors and favorable policies.

Network of trade agreements: The country has an extensive network of 14 free trade agreements spanning 50 countries, including the USMCA (United States-Mexico-Canada Agreement), the European Union, and the European Free Trade Association (EFTA). This structure facilitates preferential access to various international markets, reducing tariff barriers and promoting an enabling environment for trade and investment.

Legal framework for foreign investment: Mexico offers a legal environment that guarantees equal treatment between national and foreign investors. Foreign investors can acquire, own, and sell property in most sectors without significant restrictions. However, there are restricted areas – such as areas 50 kilometres from the coast and 100 kilometres from the borders – where direct ownership of real estate by foreigners is limited, although it is possible to invest through bank trusts.

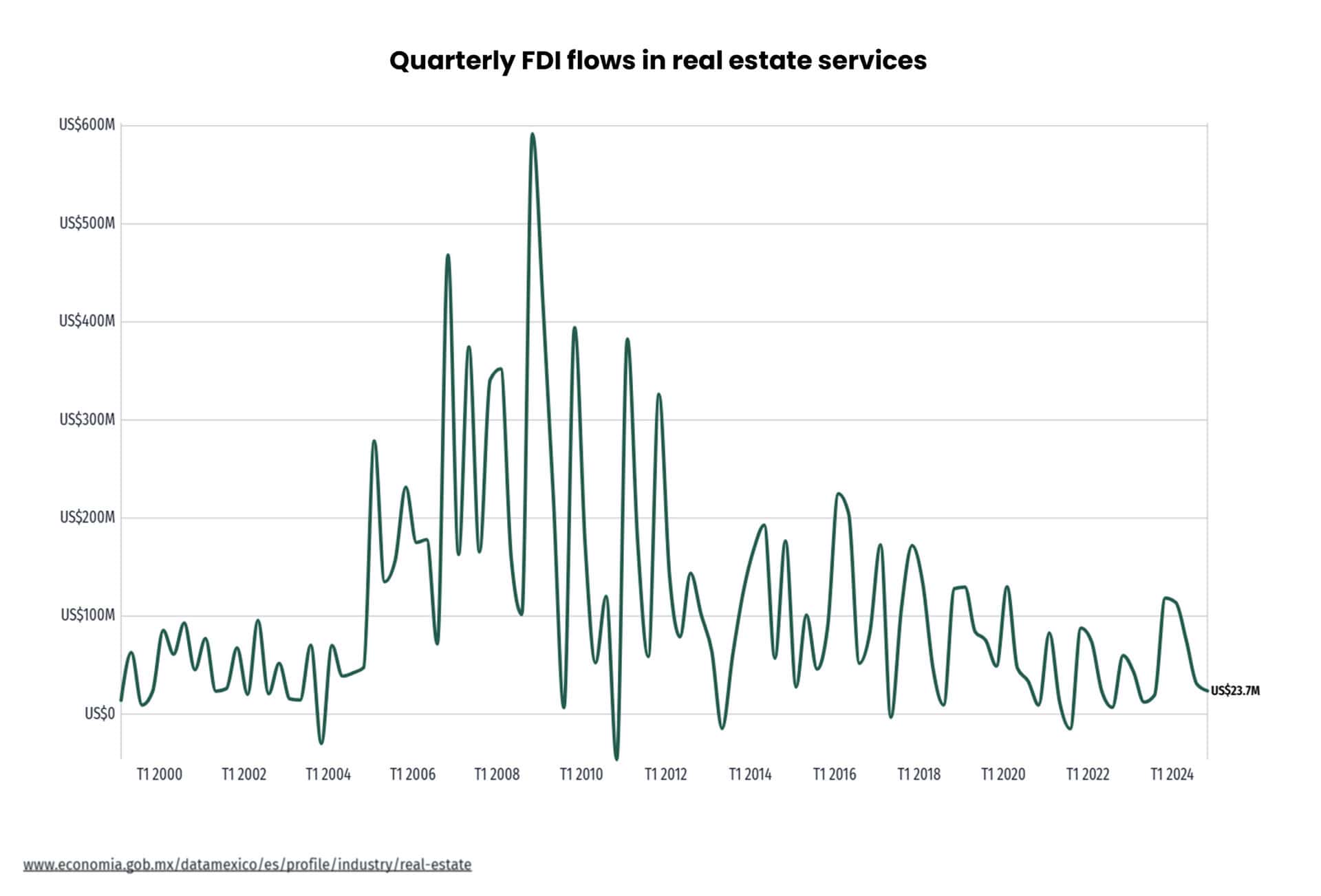

Attractive sectors for FDI: During 2023, Mexico registered a historic FDI of 36,058 million dollars, representing an increase of 2.2% compared to the previous year. Excluding extraordinary moves such as the Televisa-Univision merger and the restructuring of Aeromexico, the increase was 27%. The manufacturing industry attracted 50% of this investment, reflecting the sustained interest in this sector.

Challenges for foreign investors: Despite the favorable environment, investors face challenges such as exchange rate volatility, which can influence investment returns. In addition, although the legal framework is generally welcoming, certain strategic sectors, such as energy, have undergone regulatory changes that require detailed analysis before investing.

Foreign Direct Investment in the construction sector in Mexico

Foreign Direct Investment (FDI) in Mexico has shown a positive trend in 2024, reaching record figures in various sectors. At the end of the second quarter of 2024, total FDI amounted to 31,096 million dollars, representing an increase of 7% compared to the same period of the previous year.

However, it is important to note that the construction sector has experienced fluctuations in its growth. During the third quarter of 2024, the Gross Domestic Product (GDP) of construction showed a marked slowdown, going from a solid annual growth of 7.1% in the third quarter of 2023 to 0.4% in the same period of 2024.

Despite this moderate growth, the construction sector remains an essential component of the Mexican economy, contributing significantly to the national GDP. However, it faces challenges such as investment volatility and the need to adapt to changing economic conditions.

In summary, although overall FDI in Mexico has reached historic levels, the construction sector shows more moderate growth, reflecting the need for strategies that boost its dynamism and attractiveness to foreign investors.

Real Estate Trends for 2025 in Mexico: Technology, Sustainability and Market Changes

The Mexican real estate market is in a phase of significant transformation, driven by technological innovation, a growing focus on sustainability, and demographic shifts that redefine the demand and supply of properties.

Technological Advancements

The PropTech sector in Mexico has experienced remarkable growth in recent years. Companies such as Habi and La Haus have led this boom, facilitating the processes of buying and selling homes through digital platforms. These startups have attracted significant investments, reflecting investors’ confidence in technological solutions applied to the real estate sector.

In addition, digitizing processes, such as virtual tours and online transactions, has become common practice, improving the user experience and streamlining operations. It is expected that by 2025, the adoption of emerging technologies such as artificial intelligence and blockchain will continue to transform the Mexican real estate landscape.

Sustainability Initiatives

Sustainability has become a fundamental pillar in real estate development in Mexico. Certifications such as LEED (Leadership in Energy and Environmental Design) and EDGE (Excellence in Design for Greater Efficiencies) have gained prominence. As of 2023, Mexico had approximately 5 million square meters of buildings certified under the EDGE standard, evidencing the sector’s commitment to sustainable construction practices.

Developments such as Entrebosques in Zapopan, Jalisco, stand out for integrating residential and commercial spaces and green areas, obtaining environmental certifications that support their energy efficiency and environmental responsibility.

Market Dynamics and Demographic Changes

The preferences of the new generations are shaping the real estate market. There is an inclination towards vertical developments in dense urban areas, which offer proximity to work, entertainment and essential services. Cities such as Mexico City, Monterrey and Guadalajara are seeing an increase in mixed-use projects that combine housing, offices and retail, responding to the demand for more integrated urban living.

In addition, the trend towards the creation of “micro-cities” or planned communities that offer all the necessary services within an accessible radius is gaining traction, reflecting the desire to reduce travel times and improve quality of life.

In summary, the Mexican real estate market by 2025 is shaping up to be a dynamic environment where technology, sustainability, and changing demographic preferences will play key roles in shaping its future.

Real estate events in Mexico for 2025

Below is a list of outstanding events in the Mexican real estate sector scheduled for 2025:

Date: June 4 and 5, 2025

Location: Westin Santa Fe, Mexico City

Description: Forum organized by the Association of Real Estate Developers (ADI), considered the most important in the sector in Mexico and Latin America, where opportunities and challenges of the industry are analyzed.

Date: August 27 and 28, 2025

Location: Mexico City

Description: Meeting that connects leaders and high-level executives of the real estate industry in an intimate and informal atmosphere, with debates on current trends and investment opportunities.

Date: June 2-6, 2025

Location: Mexico City

Description: The PropTech Latam Summit Week 2025 is a prominent event that brings together leaders and professionals from the real estate and technology sector in Latin America. Scheduled from June 2 to 6, 2025 at the Citibanamex Center in Mexico City, this meeting offers a platform to explore technological innovations applied to the real estate market.

Do you want to keep up to date with the most relevant events in the real estate sector in Latin America? Visit our full events calendar and discover the key fairs, forums and meetings that are setting the tone in the region. Access the calendar here

Main real estate projects in Mexico

Mexico is experiencing a boom in landmark real estate developments looking to transform and revitalize its major cities. Below are some of the most significant projects underway:

The Rise Tower is a skyscraper under construction located in Monterrey, Nuevo León. It is expected to reach a height of 475 meters with 94 floors, making it the tallest building in Latin America and one of the tallest in the Americas. The tower will feature 34 levels of smart offices designed for new ways of working. The completion of the tower is scheduled for 2026.

The Sky is a skyscraper under construction in Merida, Yucatan. It will have a height of more than 160 meters and will have 36 levels. The project will include more than 35,000 square meters of offices and offices, commercial spaces and restaurant areas.

The Reforma Colón Tower is a skyscraper project in Mexico City. It is expected to be 316 meters tall and 72 stories, which would make it the tallest skyscraper in the city. The project includes four other mixed-use towers, such as offices, hotel and housing, connected by a commercial component. The entire complex is expected to be completed in 2025.

The University Tower is a skyscraper under construction since 2019 in Mexico City, located on the corner of Paseo de la Reforma and Lucerna Street in Colonia Juárez. It will be 203 meters high and 58 levels, making it one of the tallest buildings in the city. The project will have more than 500 apartments with a wide variety of prototypes ranging from 31 m² to 141 m², and extraordinary penthouses of more than 200 m².

The Sohl Tower, also known as Constitución 999, is a skyscraper under construction in Monterrey, Nuevo León. It will have a height of 268 meters and 62 floors, and is part of a mixed-use development that includes apartments, lofts, offices, senior living and commercial area. Construction is planned to be completed by 2025.

Conclusions: Status and prospects of the Mexican real estate market

The real estate market in Mexico is currently undergoing a moment of profound evolution. It has left behind a stage of consolidation to enter a phase of transformation, with clear signs of maturity, but also of renewal. What we see in 2024 – and project towards 2025 – is a sector that combines solid opportunities with new challenges, in an increasingly dynamic, competitive and demanding environment.

Economically, the country maintains a stable base: moderate inflation, a strong exchange rate, and a fiscal deficit under control. These elements have been key to attracting steady flows of foreign investment, which last year exceeded $36 billion, with growing interest in sectors such as industry, logistics and tourism. However, high interest rates and the difficulty of accessing credit – especially for those who work in the informal sector – continue to limit the development of the residential market.

The industrial segment, on the other hand, is in full swing. The phenomenon of nearshoring is redrawing the economic map of the country. States such as Nuevo León, Chihuahua, Jalisco and the Bajío are receiving investment like never before, with projects for industrial parks, logistics centers and technology hubs that aim to consolidate Mexico as a key player in global supply chains.

In the residential sector, prices continue to rise – with an average growth of 8.5% per year according to the SHF index – but the supply of affordable housing is still not keeping pace with demand. Factors such as rising construction material costs, limited access to financing, and growing urban pressure are forcing us to rethink what and for whom we are building. New generations, more connected, mobile and aware of the environment, are promoting different products: institutional income models, mixed-use developments and more sustainable spaces.

Bibliographic References

- Association of Banks of Mexico. (2024, September 19). Banking drives financial inclusion and the Mexican economy.

https://www.abm.org.mx/sala-deprensa/historico/Comunicado_19_09_2024.pdf

- Bank of Mexico. (2024). Economic and financial indicators.

- Mexican Center for Economic Studies of the Construction Sector. (2024, June 3). National report on the construction sector. Mexican Chamber of the Construction Industry. https://www.cmic.org.mx/ceesco/Paginas/2024/Documentos_Nacionales/Informe%20Nacional%20del%20Sector%20de%20la%20Construcci%C3%B3n%2003-06-2024.pdf

- mx. (2024). Mortgage loans: updated statistics in Mexico. https://dinero.mx/credito-hipotecario/estadisticas/

- com. (2024). Expo Real Estate Mexico 2025.

https://exporealestatemexico.com

- González, L. (2024, November). Mexican economy grows 1.6% annually in 3Q2024. Mexico, How Are We Doing?

Government of Mexico. Ministry of Economy. (2024, February). Statistical Report on Foreign Direct Investment in Mexico – 4Q2023.

https://www.gob.mx/cms/uploads/attachment/file/915793/Informe_Congreso_2023-4T.pdf

- Government of Mexico. Federal Mortgage Society. (2024). SHF Index of House Prices in Mexico. https://www.gob.mx/shf/articulos/153421

- GRI Club. (2024). Mexico GRI Real Estate 2025. https://www.griclub.org/event/real-estate/mexico-gri-real-estate-2025_4745

- (2024, September). National Survey of Construction Companies (ENEC). https://www.inegi.org.mx/contenidos/saladeprensa/boletines/2024/enec/enec2024_09.pdf

- Lamudi Mexico. (2024). Projection of the real estate sector in Mexico for 2025. https://www.lamudi.com.mx/journal/cual-es-la-proyeccion-del-sector-inmobiliario-en-mexico-para-2025/

- Leaf Latam. (2023). LEAF-certified green buildings in Mexico. https://leaflatam.com/edificios-verdes-certificados-por-leaf-en-mexico/

- Real Estate Market & Lifestyle. (2023). In Mexico, there are 5 million m² with EDGE certification.

- Real Estate Market & Lifestyle. (2024). Housing in 2025: trends that will transform Mexico’s cities.

- Analitik assesses. (2024). La Haus and Habi: vision PropTech leads the real estate sector. https://www.valoraanalitik.com/la-haus-habi-vision-proptech-lideran-sector-inmobiliario/