Real Estate Financial Modeling Accelerator (Updated January 2026)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Using the Cash-on-Cash Return in Real Estate Investment Analysis (Updated Aug 2024)

I’ve fielded a handful of Cash-on-Cash (CoC) return questions of late. So, I thought it would be worthwhile to write a post on what the Cash-on-Cash return metric tells me about a potential real estate investment. This article is a primer,…

LinkedIn Job Search 101 for CRE Professionals (Updated Aug 2024)

Our goal with this post is to help you use LinkedIn most effectively in your job search. It's the first post in a series of a LinkedIn 101 networking series to help you get the most out of this resource. Because commercial real estate is such…

Camino Hacia un NOI Estabilizado – Reservas de Capital en la Suscripción de Propiedades Inmobiliarias (Caso de Estudio)

Lograr un NOI estabilizado en bienes raíces requiere una planificación cuidadosa y una ejecución sólida. La “Reserva de Capital” es un ítem en el camino hacia un NOI estabilizado que puede causar confusión. Te has preguntado si ¿debe…

The Road To A Stabilized NOI – Underwriting Real Estate Capital Reserves (Case Study – Case Only)

Achieving a stabilized Net Operating Income (NOI) in real estate requires careful planning and sound execution. One element that can cause confusion is when underwriting capital reserves. Should they go above the line (i.e., as an Operating…

Real Estate Equity Waterfall Model With Cash-on-Cash Return Hurdle (Updated Jul 2024)

Over the years, Michael and I have built and shared numerous real estate equity waterfall models, all multi-tiered and most with internal rate of return (IRR) hurdles. And as our readers have downloaded those models, I've received dozens of…

Analyzing a Real Estate Investment from the Perspective of an LP

We received a question from an A.CRE reader this week that I thought warranted a thorough response. The question was, and I paraphrase, "I am an LP looking for models to help vet syndication deals. Do you have any models that can be used to…

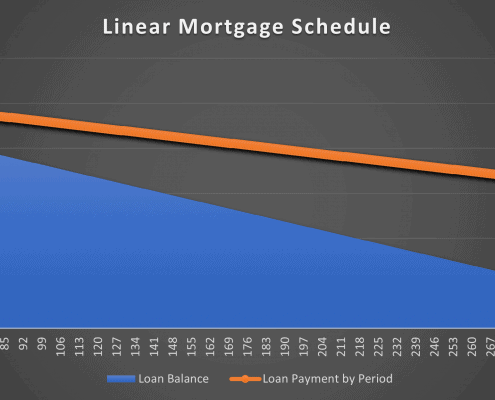

Linear Mortgage Payment Schedule Tool (Updated July 2024)

We recently shared a new modeling test to our library of real estate case studies entitled UK Debt Advisory Firm Modeling Test. In that case study, the test asked the real estate professional to analyze the returns of three different debt options.…

Tips to Nail Your Next Commercial Real Estate Interview (Updated July 2024)

Recently, our team partnered with the Graduate Real Estate Council at Cornell University where we worked with their students in providing mock interviews with Cornell alumni. Our goal in this effort was to help these students at the beginning…

STNL Sales Comp Analysis Tool – Custom GPT by A.CRE

At A.CRE, we've built dozens of custom GPTs for internal and external purposes. Some of the GPTs have general application, while others are custom GPTs specifically for commercial real estate. And among those custom GPTs specifically for CRE,…

Three LinkedIn Tips for Success in Real Estate

In the competitive world of commercial real estate, having a strong LinkedIn presence is essential. LinkedIn serves as a powerful tool for networking, job searching, and showcasing your professional achievements. It allows professionals to connect…

Una Visión General de las Funciones PAGOINT y PAGOPRIN de Excel – Usos y Desventajas (Modelo + Caso de Estudio)

Recientemente, recibimos una pregunta muy interesante en el “Q&A (Preguntas y Respuestas)” del Acelerador de Modelos Financieros Inmobiliarios de A.CRE, dicha pregunta estaba relacionada con el uso de las funciones PAGOINT Y PAGOPRIN…

How to Use Debt Yield to Calculate Loan Amount (Updated July 2024)

In our glossary of commercial real estate terms, we recently answered the question: what is debt yield? As a follow up to that entry, I thought I’d expand on the concept of debt yield by showing you how lenders use debt yield to come up with…

The Real Estate Resume – Tips and Resources (Updated July 2024)

Some of you are working to land that first professional job in real estate. Others are hoping to leverage existing education and industry experience to move up. Regardless of where you are, the content, format, and style of your real estate…

An Overview Of IPMT and PPMT Excel Functions – Uses And Drawbacks (Model + Case Study)

We recently received an intriguing question in the Q&A section of the A.CRE Real Estate Financial Modeling Accelerator regarding the uses of the IPMT and PPMT Excel functions. As such, I’d like to take the opportunity to discuss it.

First…

Case Study #12 – Maplewood Plaza: Value-Add Retail (Case Only)

For our 12th case study, we offer a challenging opportunity with a value-add retail case study. These case studies are meant to help you practice mastering real estate financial modeling. The Maplewood Plaza case study puts you in the role of…