Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Hide and Unhide Tabs using Drop-down Menus in Excel (Updated Apr 2024)

I'd like to share a handy little trick I learned this week for hiding and unhiding tabs in Excel using drop-down menus. Now this method requires you to use some basic VBA code and to save the Workbook as a Macro-Enabled file but don't be intimidated…

Watch Me Build – American-Style Real Estate Equity Waterfall (Updated Apr 2024)

A few years ago, I recorded my screen as I built a 3-tier real estate equity waterfall model. What I didn't mention in that Watch Me Build video, is that the kind of waterfall I built is colloquially called a European-style equity waterfall.…

Advanced Mortgage Amortization Schedule – Custom GPT by A.CRE

At A.CRE, we've built dozens of custom GPTs for internal and external purposes. Some of the GPTs have general application, while others are custom GPTs specifically for commercial real estate. One such CRE-specific GPT that we recently built…

The Definitive Guide to Microsoft Excel for Real Estate (Updated Apr 2024)

Microsoft Excel is the primary tool used by real estate financial modeling professionals. Even while numerous non-Excel alternatives have attempted to de-throne Excel, the 35+ year-old software has shown to be surprisingly resilient to competition.…

Optimizando Espacios: Modelo de Cálculo Para la Ocupación Física de Inmuebles

Comprender y optimizar la ocupación física y económica de tus inmuebles es crucial para maximizar el retorno de inversión y mejorar la gestión de propiedades. El desarrollo de un modelo efectivo para el cálculo de la ocupación no solo…

The Conditional Weighted Average – SUMPRODUCT with SUMIF (Updated Apr 2024)

Consider this scenario: you have a 50 tenant rent roll, consisting of various tenant types (i.e. small inline, large inline, junior anchor, anchor, etc.), and you want to calculate the weighted average rent for each tenant type. If I asked you,…

Insights from Spencer’s Cornell Real Estate Distinguished Speaker Series Interview

Recently, our own Spencer Burton was invited to participate in the Cornell Real Estate Distinguished Speaker Series, a platform renowned for hosting leading voices in the real estate industry. During this prestigious event, Spencer had the opportunity…

How to Prepare for the Real Estate Technical Interview (Updated Apr 2024)

So you've made it past the HR screening interview. You have the education and experience the company is looking for, but now they want to be sure you possess the real estate financial modeling skills necessary to do the job. They've asked…

Multifamily Development Model (Updated April 2024)

Not to be confused with Spencer's masterpiece, The A.CRE Apartment Development Model, I decided to build a second option on our website for multifamily development with a different feel. For us true modeling nerds out there, we know that financial…

Cómo Utilizar el Rendimiento de la Deuda y el Índice de Cobertura del Servicio de la Deuda Para Calcular el Importe de un Préstamo

En nuestro glosario de términos inmobiliarios comerciales, encontraremos 2 conceptos bastante interesantes, que a su vez son métricas y vías para evaluar la factibilidad de un proyecto inmobiliario en última instancia.

Por su parte, la…

Como Analizar Inversiones Inmobiliarias de Valor Agregado Mediante el Rendimiento Sobre el Costo

El rendimiento sobre costo en los bienes raíces comerciales es un indicador financiero crítico que mide la rentabilidad de una inversión inmobiliaria comparando los ingresos operativos netos que genera una propiedad con el costo total de…

¿Qué son los GPTs personalizados? Y algunos breves ejemplos que hemos creado

En el mundo de rápida evolución de la inteligencia artificial y nuevos modelos avanzados de lenguaje generativo (IA generativa), mantenerse al día con los avances tecnológicos es crucial para los profesionales de todos los campos, especialmente…

Terminology Guide for Build-to-Rent Investment

We recently released a Build-to-Rent (BTR) Development model to help students and developers better analyze this emerging investment type in commercial real estate. As we explored this type of analysis, it became clear that terminology is often…

Glossary of Commercial Real Estate Terms (Updated Apr 2024)

Glossary of Commercial Real Estate Terms

Welcome to the A.CRE Glossary of Commercial Real Estate Terms, a practitioner's guide to the most common terms in CRE. This is an ever-growing list of commercial real estate terms and definitions that…

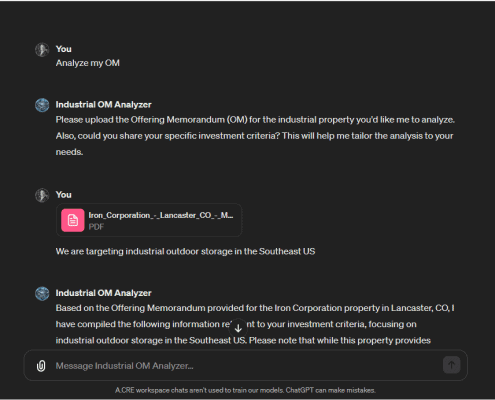

Watch Me Build – Industrial Offering Memorandum Analyzer Custom GPT

In this Watch Me Build session, I'll walk you through constructing a custom GPT that near-instantly sifts through Industrial Offering Memorandums to pinpoint whether an investment aligns with your criteria. At the heart of this build is a tailored…