Real Estate Financial Modeling Accelerator (Updated September 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

What to Look for in a 1031 Qualified Intermediary – A Real Estate Investor’s Checklist

With several decades of experience in commercial real estate, we've become adept at navigating the complexities of 1031 exchanges. Recognized as a powerful tool in the United States, 1031 exchanges allow for the compounding of lifetime real…

Ingeniería de Prompts de IA en Bienes Raíces Comerciales: Un Marco Efectivo

Para finales de 2022, en A.CRE empezamos a sumergirnos en serio en el mundo de la IA. Desde entonces, hemos compartido numerosas publicaciones de blog que exploran casos de uso de AI y materiales de formación. También hemos compartido y creado…

Using an IRR Matrix to Determine Hold Period (Updated Dec 2023)

When building a real estate financial pro forma, it's important to model for and include a summary of various return and risk metrics. Among the different return metrics, the internal rate of return (IRR) - both on an unlevered and levered…

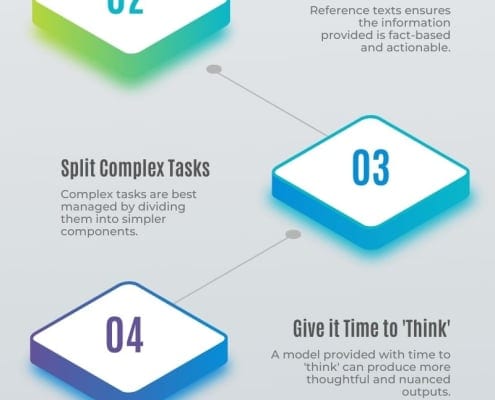

Strategies for Better AI Prompting

In the commercial real estate industry where precision and foresight are essential, artificial intelligence - and generative AI in particular - has emerged as a game-changer. AI, through language models like ChatGPT and Google Bard, can sift…

Tips Para Establecer Contactos en LinkedIn: Construye Mejores Resultados a Través de tu Red de Conexiones

Construir tu red de contactos en LinkedIn es una forma proactiva de obtener una ventaja en el proceso de contratación y de protegerse contra la incertidumbre cuando estás luchando por encontrar un trabajo. Este artículo forma parte de nuestra…

Actual + Forecast Construction Draw Schedule with S-Curve (Updated Dec 2023)

Several times in the last month, I've been asked to tackle an interesting real estate financial modeling challenge - pare actual construction draw cash flows with s-curve cash flow forecasts to create an Actuals + Forecast Construction Draw…

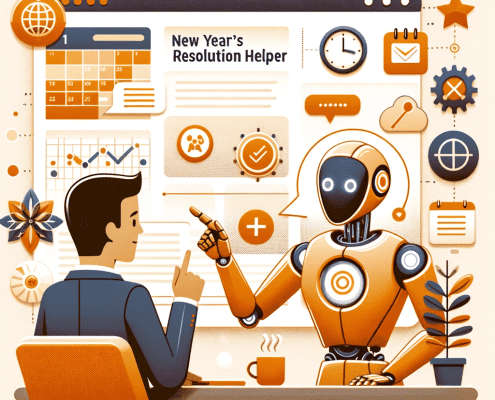

Set Your New Year’s Resolutions Using Our Custom GPT

As we approach the end of the year, it's a time many of us pause to reflect and plan for the future. In my own career, I've always found the transition into a new year to be a prime opportunity for setting ambitious yet achievable goals. This…

1031 Exchange – List of Concepts and Terms

Welcome to our comprehensive list of concepts and terms common to the 1031 Tax-Deferred Exchange. This resource is crafted to help professionals, investors, and others understand the terms used as part of a 1031 exchange in real estate.

The…

LBO vs CRE Acquisition Models and Using LBO Structure to Acquire CRE

In the world of investment and finance, models play an integral role in guiding decision-making processes, evaluating risk, and forecasting returns. Two such influential models are the Leveraged Buyout (LBO) Model and the Commercial Real Estate…

Actores públicos y privados y sus implicaciones en el mercado inmobiliario comercial colombiano

La importancia del análisis financiero en el ámbito inmobiliario es universalmente reconocida, pues constituye la columna vertebral del éxito de las inversiones y la viabilidad de los proyectos. Sin embargo, mi experiencia en este campo después…

8 Considerations When Reviewing a Broker’s Financial Model Setup

Whether you’re an analyst, operating in acquisitions, or working in a different property-related role, it’s essential to have the skills required to qualify an opportunity, which typically includes reviewing a broker’s financial model…

Bienes Raíces Comerciales en Colombia: Una Guía básica para Navegar en el Mercado

En mi rol en A.CRE, siempre he enfocado mis esfuerzos en avanzar y crecer. Esta filosofía se ha fortalecido a través de las lecciones aprendidas con el Acelerador de A.CRE, donde he descubierto la importancia de la paciencia y la diligencia…

Introducing Weighted Equity Multiple: An Alternative for Dynamic CRE Investments

Across a 22+ year career in the industry, I've encountered a range of complex scenarios that traditional metrics sometimes struggle to accurately capture. A case in point that has been top of mind for me recently is a weakness in the Equity…