Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

4-Tier Equity Multiple Waterfall – Download and Watch Me Build (UPDATED APR 2022)

Here is a simple, yet very powerful, 4-tier equity multiple waterfall module. This post contains both a completed version of the module ready to plug into a real estate financial model as well as a 'Watch Me Build' template and companion video…

3 Tips for When You’re Unhappy in Your Current Job

As a CRE recruiter, I often get questions from people who are unhappy in their current job. This is a very common situation for people to have - in both commercial real estate and in other fields. However, I want to let you know that this isn't…

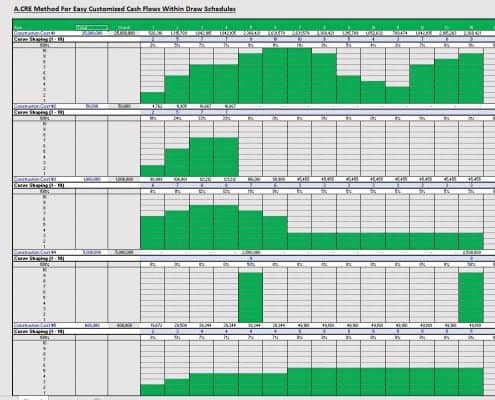

Development Draw Schedule – Visually Customize Each Line Item (UPDATED APR 2022)

Working a lot with development draw schedules, I have always been looking for a catch all solution as to how one could easily model all the unique ways cash actually flows over time during the process. The norm for many is to model cash flows…

Setting Up a New Real Estate Financial Model – Date and Period Headers Plus Formatting (Updated Apr 2022)

We've spent a lot of time here discussing and sharing different real estate models, and we've received a ton of feedback from our readers as a result. In some of that feedback we've received, several people have asked what period and date rows…

Office Purchase and Sales Agreement

This article outlines specific concerns related to an office commercial real estate purchase and sales agreement. Below, we'll discuss the clauses in the agreement to adjust from a neutral agreement between buyer and seller. You can download…

Construction Draw Schedule: Accounting For True LTC (Updated Apr 2022)

When lenders provide debt for a development project, they lend based on a Loan-to-Cost ratio (LTC), which is simply the percent of the total budget the lender will agree to lend to the borrower. So, if a project costs $10MM, and a lender loans…

How Innovation is Poised to Disrupt Development with Aleks Gampel | S3SP7

This episode of the A.CRE Audio Series features Aleksandr Gampel, a real estate professional and co-founder of Cuby Technologies. Cuby is a tech company working to innovate current real estate construction and development methods.

As Aleks…

Land Equity – Collaborative Development Strategies with the Landowner

In this article, we'll talk about land equity development strategies where the landowner contributes their land to the partnership. In these situations, land ownership is either immediately conveyed or deferred until development is complete.…