Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

https://www.adventuresincre.com/wp-content/uploads/2021/05/Day-in-the-Life-Managing-Director-scaled.jpg

2560

1709

A.CRE

https://adventuresincre.com/wp-content/uploads/2022/04/logo-transparent-black-e1649023554691.png

A.CRE2021-05-27 05:00:122023-01-17 10:51:59Day in the Life – Managing Director – REPE Firm

https://www.adventuresincre.com/wp-content/uploads/2021/05/Day-in-the-Life-Managing-Director-scaled.jpg

2560

1709

A.CRE

https://adventuresincre.com/wp-content/uploads/2022/04/logo-transparent-black-e1649023554691.png

A.CRE2021-05-27 05:00:122023-01-17 10:51:59Day in the Life – Managing Director – REPE Firm

Maximizing Your ROI on In-Person CRE Events

The world is opening back up, and that means that in-person events are getting going again. While this is an exciting development, many of us are rusty as it relates to our in-person networking skills. In this episode, watch as Spencer, Sam,…

Could You Be Exiting Too Early? Don’t Forget to Analyze Your Reinvestment Rate

When attempting to maximize the value of your money invested in real estate, the timing of your exit is key to maximize your return. Exit too early, and you might leave money on the table. Exit too late, and you might have better used that capital…

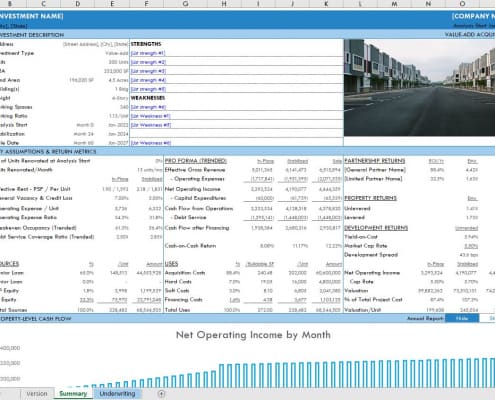

Tutorials for A.CRE Value-Add Apartment Acquisition Model

As promised, I'm following up the release of the A.CRE Value-Add Apartment Acquisition model with a series of walk-throughs and tutorials to help you better understand the various elements of the model. The tutorials start with the basics -…