Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Model Like a Deal-Seasoned Pro – S1E10

Welcome back to the A.CRE Audio Series. In this episode, we chat once again with the creators Adventures in CRE, Spencer Burton and Michael Belasco, about the A.CRE Accelerator Program. The Accelerator is their premium training…

Roll Up Your Monthly Cash Flow Line Items Into Annual Periods Using Only One Formula For The Whole Sheet

While building out my hotel development model (currently underway), I decided to take a break and record a video about how I roll up the monthly cash flow line items on my Monthly Cash Flow sheet into annual cash flow line items on a separate…

Hotel Acquisition Model – The Basic Model (Updated 10.9.2019)

The initial goal for the original Hotel Acquisition Model was to design a hotel proforma that would enable users to get deep into the weeds of practically every line item in their hotel analysis. Although I am super happy with how that hotel…

Graduate Real Estate Series: MIT MSRED

The Massachusetts Institute of Technology's Master of Science in Real Estate Development (MSRED) program is an eleven (or 16) month graduate program in real estate offered through MIT's Center for Real Estate. Espousing MIT's motto: Mens et…

30/360, Actual/365, and Actual/360 – How Lenders Calculate Interest on CRE Loans – Some Important Insights

(Updated August 7, 2019 to include a Watch Me Build video and Downloadable file)

Commercial real estate lenders commonly calculate loans in three ways: 30/360, Actual/365 (aka 365/365), and Actual/360 (aka 365/360). Real estate professionals…

Tutorials For The Hotel Valuation Model (Updated 07.23.19)

Welcome to the A.CRE Hotel Valuation Model's Tutorial Page. On this page you will find all the tutorials for the A.CRE Hotel Valuation model in Excel. There is a lot to learn within this model and over time, I'd like to show you both how to…

Using the Floating Summary Box in Real Estate Modeling

Over the next few minutes, I'll share a great modeling tip for efficiently visualizing the more salient metrics in your real estate models. Now I should mention, this is a tip I shared a few years ago. But given the complexity of many of the…

Day in the Life: EVP/Asset Manager – Family Office

In this 'Day in the Life of a Commercial Real Estate Professional' post, we hear from an EVP/Asset Manager working at a Family Office in California where this person has been located for the last 2 years. This professional has been kind enough…

Using the OFFSET Function in Real Estate Financial Modeling

In a previous post, I showed you how to use the OFFSET function to create dynamic lists in Excel. As you become more comfortable using this function in real estate financial modeling, you'll find that it has almost infinite applications when…

A.CRE 101 – Create Smart Drop-Down Menus in Real Estate Modeling

One Excel feature real estate financial modeling professionals use often is the data validation list. Where data validation is a method of limiting the possible inputs of a cell, the data validation list limits those inputs to a pre-defined…

Create a Dynamic Real Estate Chart in Excel

Most of the real estate financial models we've shared over the years are dynamic to analysis period. Meaning, we've included an input to adjust the length of the analysis period, and the model will adjust the results accordingly.

This is…

3-Tiered Acquisition Debt Module

This is a 3-tiered debt module that will allow the user to add one to three tiers of debt to his or her real estate DCF model. Includes the option to layer in senior debt, secondary debt, and mezzanine debt; calculate interest on either…

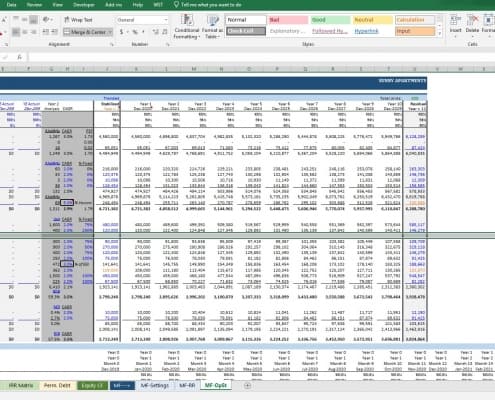

Quick Tutorial: Add Line Items to OpSt Sheet in All-in-One

I was recently asked the question whether it's possible to add more other income or operating expense line items to the MF-OpSt or ORI-OpSt worksheets in my All-in-One Model for Underwriting Acquisitions and Development. Short answer is: out…

Deep Dive: Understanding Acquisitions: The Letter of Intent (LOI)

The Letter of Intent - Legal Issues

The letter of intent is a critical document that is written up at the beginning of a potential real estate transaction between either a prospective buyer and seller or a prospective tenant and landlord.…

Graduate Real Estate Series: Columbia University MS.RED (Updated 2.2.2019)

The Columbia University Master of Science of Real Estate Development (MS.RED) program is an intensive, three term (one year) graduate program in real estate offered through Columbia University's highly ranked Graduate School of Architecture,…