Real Estate Financial Modeling Accelerator (Updated September 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Excel-Based Restaurant Selection Tool for the Overly Indecisive

We're celebrating some much deserved time off from work, and so what better way to spend the time than to make a completely unnecessary (but fun!) Excel model. I call this the indispensable Excel tool for the overly indecisive, and it's basically…

Hotel Proforma Basics – Hotel Cash Flow Projection

Hotels are a unique asset in the commercial real estate world and are underwritten differently as a result. Probably the most obvious difference is the duration of the 'lease term' of the tenant, which is usually daily to weekly. Another major…

https://www.adventuresincre.com/wp-content/uploads/2018/11/Lathan.jpg

858

951

Michael Belasco

https://adventuresincre.com/wp-content/uploads/2022/04/logo-transparent-black-e1649023554691.png

Michael Belasco2018-11-19 01:03:102023-01-19 09:04:11Check Out the Latest Installment of Our ‘Day In The Life of a CRE Professional’ Series

https://www.adventuresincre.com/wp-content/uploads/2018/11/Lathan.jpg

858

951

Michael Belasco

https://adventuresincre.com/wp-content/uploads/2022/04/logo-transparent-black-e1649023554691.png

Michael Belasco2018-11-19 01:03:102023-01-19 09:04:11Check Out the Latest Installment of Our ‘Day In The Life of a CRE Professional’ Series

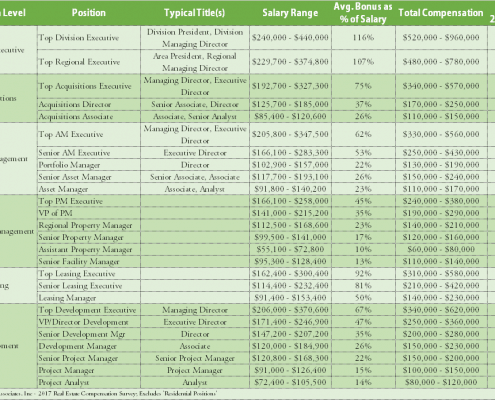

Real Estate Salary and Benefits (United States 2018)

Several years ago, we published a careers in real estate series where we discussed the various job sectors, business fields, and job functions that exist in the real estate industry. Additionally, we broke down compensation in real estate (salary…

Back-of-the-Envelope Office, Retail, Industrial Acquisition Model (Updated 10.1.2018)

I’ve built a new acquisition model that I am excited to share with our readers. This is a back-of-the-envelope (BOE) valuation model that can be used for retail, office, and industrial properties. The goal was to create a sleek and clean look…

Excel Speed Tip – Insert or Delete a Row or Column Without a Mouse

Using keyboard shortcuts is essential to improving the speed and efficiency at which you model real estate in Excel. One thing you'll learn early in your CRE career, the more proficient you become in using your keyboard without a mouse to navigate…

Understanding Treatment of Time 0 in the All-in-One Model

I received a very astute question/concern from a user of our All-in-One(Ai1) model in our Ai1 Support Forum late last month. I initially set out to answer the question in writing, but the more I thought about my response, the more I concluded…

All About Cap Ex

In this post, we are going to take a deeper look into capital expenditures. What it is and how we account for it in cre underwriting.

Capital expenditures, commonly referred to as Cap Ex, are expenses that occur outside of normal operating…

Deep Dive: The IRR and XIRR – Fully and Simply Explained (Part 2)

Part 2: The XIRR

(Click here for Part 1 where we cover the IRR)

This is Part 2 of our A.CRE Deep Dive - 2-part mini-series on the IRR and XIRR return metrics and functions in Excel. As stated in Part 1, these are some of the most commonly…

Deep Dive: The IRR and XIRR – Fully and Simply Explained

For my next post, I thought I would bring it back to some fundamentals and review the IRR and XIRR return metrics and functions in Excel. These are some of the most commonly used functions and return metrics in commercial real estate and they…

A.CRE User Insights Survey

We need your help! As Adventures in CRE (A.CRE) has grown and evolved over the years, so have the needs of our readers. The challenge for Michael and I as we contemplate what new content to create, is knowing what resources will be most beneficial…