Real Estate Financial Modeling Accelerator (Updated September 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

The State of Real Estate Crowdfunding

Following the housing crash of 2007 - as regulations were introduced and credit tightened - emerging companies were left with little or no access to the capital markets. In an effort to ameliorate the credit crunch, Congress drew up the Jumpstart…

How to Post and Edit a Job

Posting or editing your commercial real estate job on the Adventures in CRE Job Board is quick and easy. To learn how, watch the video or read the instructions below. If you have any questions, check out our FAQs page or send us an email. Before…

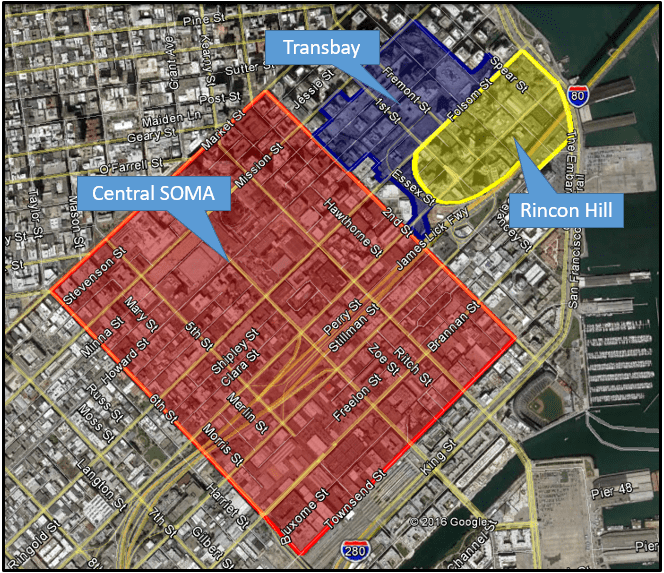

San Francisco Development Explosion! – Interactive Map & Side Project

San Francisco's downtown area is currently going through an unprecedented, skyline redefining transformation. So many incredible developers and architects are in the process of leaving their mark on this city and it's all happening or will…

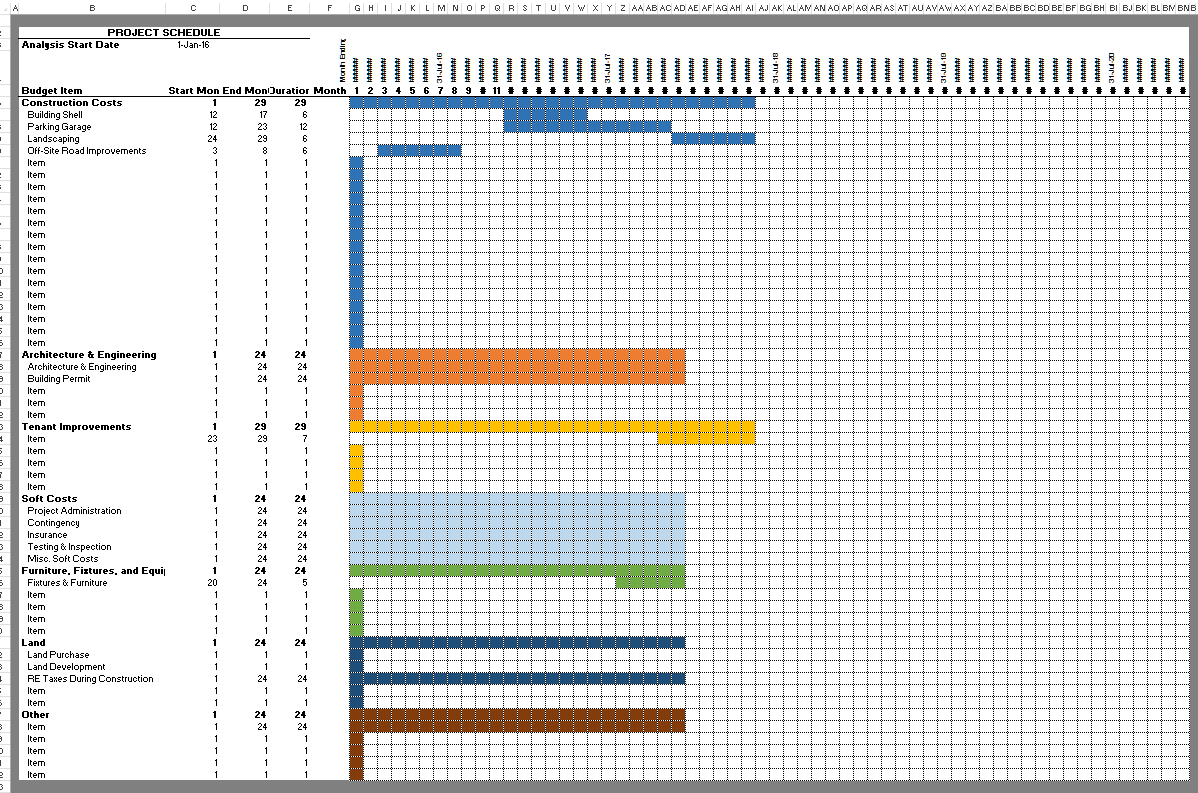

Bonus Content – Gantt Chart and Weighted Average with Multiple Conditions

I have two updates/improvements to previous posts I thought I'd share with our readers today; call it, bonus content! The first, is a dynamic Gantt Chart tool I recently added to my Construction Draw and Interest Calculation Model. The second,…

Michael to SF – Spencer to Dallas

I thought I'd write a quick post and update our readers on some exciting news around here. As many of you may (or may not) know, Michael and I met while working on our graduate real estate studies at Cornell University. We started adventuresincre.com…

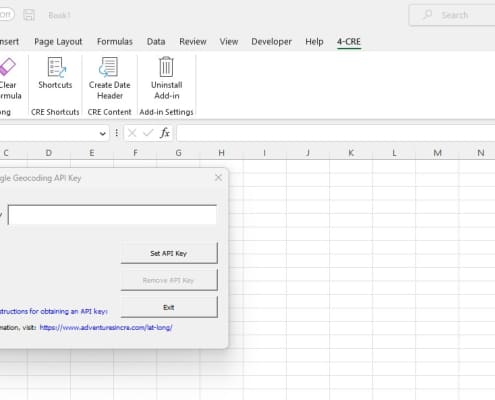

Supercharge Excel with the WST Macros Add-in

In 2016, I wrote about Wall St. Training and their free Excel modeling resources. In that post, I mentioned the free WST Macros and how it is an indispensable add-in; one that I used in my professional life daily.

Unfortunately, as of 2023,…

Understanding Taxes Series: Part 2 – Exceptions to The PAL Rules

The PAL Rules - A Brief Background

The PAL Rules, or Passive Activity Loss Rules, were enacted in 1986 to curb rampant abuses from people using real estate and businesses to generate huge losses to offset income taxes. It used to be that you…

Getting to Know Our Readers – Ben Stevens and The Skyline Forum

Maintaining a vibrant, ever-changing blog is not an easy endeavor, and I’ll be the first to admit that it’s not always fun. But what makes blogging worthwhile for Mike and I is the opportunity the blog creates to interact, either through…

How to Use the Apartment Acquisition Model’s Monte Carlo Simulation Module

You may recall that a couple of weeks ago, I began to explore Stochastic Modeling concepts, or the idea of adding probability into my models, to get a more complete picture of the risk-return metrics of an investment. I became interested in…

Waterfall Model For Real Estate Joint Ventures with Catch Up

I've just wrapped up a new JV waterfall model with catch up clause that I am excited to share on the site. This model was built as an addition to my back-of-the envelope retail/industrial/office acquisitions model I posted a few weeks back.…

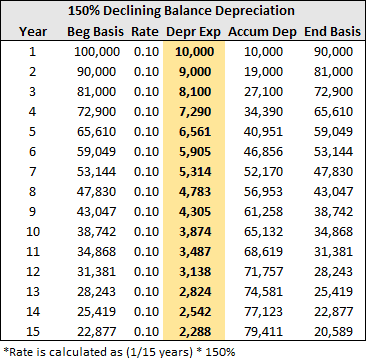

Understanding Taxes Series: Part 1 – Depreciation

Investing in real estate provides some tremendous tax incentives in the USA compared to other investments and is an important component to understanding real estate investing. Given the positive response I've received to my Understanding Leases…